Lima telco disiasat

- Details

30/11/2020, Isnin

30/11/2020, Isnin

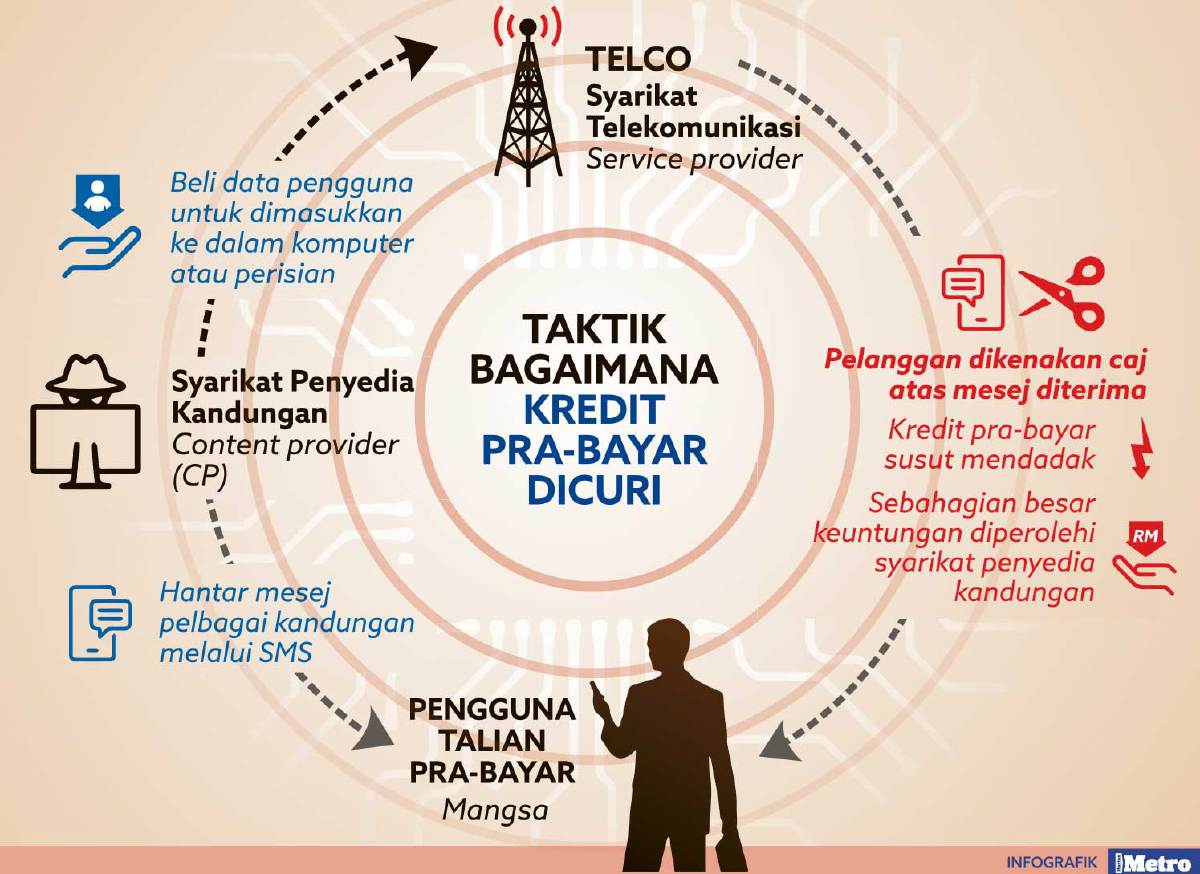

Kuala Lumpur: Dianggarkan hampir 100 syarikat penyedia kandungan dikesan melakukan jenayah 'menyedut' kredit prabayar milik pengguna telefon bimbit menyebabkan mangsa kerugian hampir RM100 juta sejak 10 tahun lalu.

Difahamkan syarikat ini aktif 'mencuri' wang milik pengguna talian prabayar hasil kegiatan membeli data peribadi pengguna dengan menyogok kakitangan syarikat telekomunikasi (telco) tempatan.

Sumber Suruhanjaya Pencegahan Rasuah Malaysia (SPRM) mendedahkan kepada Harian Metro, syarikat ini akan menghantar pelbagai kandungan mesej melalui sistem pesanan ringkas (SMS) ke telefon bimbit pelanggan talian prabayar sebelum mangsa dikenakan caj antara 50 sen hingga RM5 bagi setiap penghantaran 'sampah.'

Menurutnya, ramai pakar teknikal dan 'orang penting' syarikat telco yang dikesan bersekongkol dengan menjual data peribadi milik pelanggan berdaftar talian prabayar.

"Jika diambil kira jumlah kerugian pengguna prabayar di negara ini susulan aktiviti haram dikesan, SPRM menganggarkan ia mencecah RM100 juta jika mengambil kira peratusan keuntungan diperoleh telco dan syarikat penyedia kandungan ini," katanya.

From online shopping to offline let-downs

- Details

Sunday, 29 Nov 2020

Sunday, 29 Nov 2020

MORE Malaysians are shopping online these days and especially with Christmas next month, itโs always a good idea to be careful before you buy anything.

A total of 1,520 complaints on online shopping through social media were reported to the National Consumer Complaints Centre (NCCC) as of November this year.

Most claimed to be scammed by sellers, with the top types of items involved being electronic gadgets like handphones and power banks, clothes, watches and womenโs accessories.

Another 1,646 complaints were against retailers and sellers of products related to Covid-19 like face masks, hand sanitisers and health supplements, the NCCC tells Sunday Star.

For purchases on social media, NCCC senior manager Baskaran Sithamparam says sellers on Facebook, Twitter and Instagram are not bound by refund or return policies like those who are on legitimate online marketplaces.

And this has led many consumers to be taken for a ride.

โSome did not receive the items they ordered at all or received only part of the item, โ he says.

Mule account: 10 arrested for manipulating ATM cards of victims - Bukit Aman

- Details

November 25, 2020 08:22 MYT

November 25, 2020 08:22 MYT

KUALA LUMPUR: Ten members of a mule account syndicate were arrested in raids by Bukit Amanโs Commercial Crime Investigation Department around Kuala Lumpur and Selangor from Nov 5 to 10.

The syndicate uses bank accounts of low-income individuals for illegal activities such as investment fraud and other scams.

Bukit Aman CCID director Datuk Zainuddin Yaacob said all the suspects arrested were locals aged between 20 and 32 comprising seven men and three women, and they were believed to have purchased each ATM card for between RM500 to RM800 from members of the public.

Members of the syndicate are believed to influence 'investors' by promising them a healthy return, and after a victim places money into the account, they will withdraw it via automatic teller machine (ATM) cards obtained from the account holders who are unaware that the accounts are being used for fraud.

"Following the arrests, the police have received a total of 32 reports involving mule account cases nationwide, involving losses worth about RM1.2 million,โ he said.

Zainuddin said members of the syndicate were also found renting condominiums for between RM3,000 to RM5,000 a month to prevent their activities from being detected by the authorities.

Read more: Mule account: 10 arrested for manipulating ATM cards of victims - Bukit Aman

Bijak urus wang Akaun 1 KWSP

- Details

November 23, 2020 @ 8:56am

November 23, 2020 @ 8:56am

KEPUTUSAN kerajaan memberi kemudahan akses simpanan persaraan Akaun 1, i-Sinar kepada lebih dua juta pencarum Kumpulan Wang Simpanan Pekerja (KWSP) melegakan banyak pihak, terutama mereka terjejas teruk akibat pandemik COVID-19.

Perubahan jumlah pengeluaran antara RM4,000 hingga RM60,000 secara bersasar dilihat lebih praktikal berbanding pengeluaran RM500 sebulan selama 12 bulan seperti dicadangkan dalam pembentangan Belanjawan 2021 sebelum ini.

Kesediaan kerajaan meminda cadangan yang sudah dibentangkan di Parlimen itu bukan mudah. Ia membabitkan pelbagai implikasi. Namun, jelas ia membuktikan kerajaan memahami kegetiran hidup rakyat.

Kepada pencarum pula, wang yang bakal dikeluarkan nanti seharusnya digunakan secara berhemah. Lebih penting, ia ke jalan betul.

Sebaiknya gunakan wang berkenaan sebagai modal permulaan perniagaan atau membayar hutang tertunggak. Lebih penting, beban perbelanjaan kehidupan seharian dan urusan persekolahan anak dapat dikurangkan dengan wang terbabit serta diuruskan dengan baik dan teratur.

Pendidikan digital tangani cabaran wabak

- Details

November 20, 2020 10:24 am

November 20, 2020 10:24 am

Teks disediakan oleh Sekretariat Akhbar Pejabat Datoโ Menteri Besar yang disiarkan dalam akhbar SelangorKini edisi 19 hingga 25 November 2020

โDalam apa-apa bentuk sistem ekonomi sekalipun, pemerintah memainkan peranan yang penting dalam pendidikan dan latihan. Dan jika pemerintah ingin membebaskan rakyatnya daripada belenggu kemiskinan, ia perlu memulakannya dengan pelaburan meningkatkan mutu manusia; pelaburan dalam kesihatan โ kerana manusia yang sering sakit mempunyai produktiviti yang rendah; pelaburan dalam pendidikan dan keterampilanโ.

โ Datuk Seri Anwar Ibrahim,

Gelombang Kebangkitan Asia, 1997

Keutamaan pendidikan ternyata tidak ada tolok bandingnya. Kemiskinan, yang sering dianggap musuh nombor wahid negara-negara di dunia, memang memerlukan pendidikan sebagai salah satu wadah utama dalam memeranginya.

Tidak mengejutkan apabila kemiskinan dikira sebagai salah satu pintu kepada kekufuran di dalam agama Islam. Dan kepentingan pendidikan jelas terjelma dalam kisah penciptaan Nabi Adam A.S sendiri yang mana, perkara pertama yang Allah S.W.T lakukan adalah mendidik baginda tentang โnama-namaโโ suatu proses asuhan terawal buat manusia seluruhnya. Saranan untuk terus belajar dan belajar diperkukuh kemudiannya dengan proklamasi โIqraโโ atau โBacalah!โ yang menjadi ayat pertama yang diturunkan kepada junjungan besar Nabi Muhammad S.A.W.

How much can consumers really drive responsible business?

- Details

We are in the midst of an environmental and social crisis. That might sound alarmist, but recent events have proven this to be an inconvenient truth.

We are in the midst of an environmental and social crisis. That might sound alarmist, but recent events have proven this to be an inconvenient truth.

As the worldโs population continues to grow to reach 10 billion people by 2050, governments and businesses will need to find drastically different ways to make the food, products and resources we rely on to live.

We speak about the environmental and social challenges we face related to the climate crisis and inequality in our first posting of this publication, A sustainable post COVID-19 economic recovery: how the facts show us there is no other option.

Faced with this new reality, what can we do to create the systemic shift required to create a more sustainable and equitable society? And which factors can play a role in pushing companies in particular to take responsibility for their corporate footprints?

In other words, which drivers can encourage companies to consider their impact on both people and the planet as an intrinsic part of their operations?

The economic and social fallout from COVID-19 has accelerated scrutiny and debate about what stakeholder capitalism means in practice for company decisions and actions. A growing number of investors are viewing environmental and social risks as financial risks, and are pushing companies to consider them.

Read more: How much can consumers really drive responsible business?

TNB expands Smart Meter installation. Hereโs what you need to know

- Details

16 NOVEMBER 2020

16 NOVEMBER 2020

Tenaga Nasional Berhad (TNB) is expanding the use of smart meters in more premises nationwide. The new connected meters will provide a more efficient and accurate power consumption reading, while allowing users to better monitor their usage.

TNB has successfully installed 340,000 smart meters in Melaka and they targeting to install 1.2 million units for residential and commercial premises in the Klang Valley. The power utility company also aims to expand the smart meter usage to cover 9 million premises by 2021.

What is a Smart Meter?

Unlike traditional meters which requires manual reading by a TNB personnel, power consumption measurements on a smart meter can be done remotely. Users with the smart meter can view energy usage updates in 30-minute intervals from the myTNB portal or via the myTNB app. The smart meter itself wonโt reduce power consumption, but it will help users to better track and manage their energy use.

Since the meters are connected, it could reduce the need for manual reading and it also improves TNBโs power outage detection.

Read more: TNB expands Smart Meter installation. Hereโs what you need to know

Take tougher action against โbad applesโ, urges the beauty industry

- Details

Monday, 16 Nov 2020

Monday, 16 Nov 2020

IT was a tragic incident that took away the life of a 23-year-old model, who was supposed to get married at the end of the year.

A botched liposuction from an unlicensed beauty salon allegedly led to Coco Siewโs untimely death last month (October).

The beauty industry reeled from the news, calling on authorities to take stiffer action against unregistered practitioners to prevent another tragedy.

So far, the National Consumer Complaints Centre (NCCC) received 420 complaints this year involving the wellness and aesthetic industry, with most being about refunds.

โOnly a handful are involving health-related incidents, โ NCCC senior manager S. Baskaran tells Sunday Star.

In 2018, the NCCC received 1,771 complaints involving the beauty sector, with most disputes on refunds (19.2%), poor service (9.9%) and misleading information (9.3%).

โSome 6.8% of complaints were about health complications with some suffering side effects like irregular heartbeat or headache from slimming drinks or other services, โ he says.

Read more: Take tougher action against โbad applesโ, urges the beauty industry

Beware of scammers disguised as authentic online sellers during 11.11 sale, warns Consumer Complaints Centre - NCCC

- Details

Tuesday, 10 Nov 2020

Tuesday, 10 Nov 2020

PETALING JAYA: Itโs time once again for the 11.11 online sale, but consumers have been urged to be wary of scammers pretending to be legitimate sellers.

Over 1,520 complaints on the sale of goods online through social media such as Facebook, Twitter and Instagram were received by the National Consumer Complaints Centre (NCCC) over the past 10 months.

โMany have complained that their purchased goods never reached them, โ NCCC senior manager S. Baskaran told The Star Tuesday (Nov 10).

He said the NCCC wanted to warn consumers before the annual online sale begins at 12.01am Wednesday (Nov 11).

โOnline shoppers need to be wary each time they buy from online platforms, especially social media.

โSome scammers will disguise themselves as authentic sellers and use the 11.11 sale as their platform to trick more gullible consumers.

โConsumers need to verify if the seller is genuine first. Donโt be an easy prey, โ Baskaran added.

Consumer Credit Act lauded - FOMCA

- Details

Wednesday, 11 Nov 2020

Wednesday, 11 Nov 2020

ONE of the most important announcements from Budget 2021 is the formulation of a Consumer Credit Act aimed at providing a regulatory framework for the issuance of consumer credit and strengthening the supervision of non-bank credit providers.

Fomca (Federation of Malaysian Consumers Associations) has long advocated for this Act to enhance consumer protection in the financial sector.

After the Act is formulated, it is hoped that it would be enforced by Bank Negara Malaysia and the Securities Commission.

Three credit forms that are of great concern to Fomca are hire purchase, money lending and pawn shops. The Hire Purchase Act is under the jurisdiction of the Domestic Trade and Consumer Affairs Ministry while the Moneylenders Act and Pawnbrokers Act are both under the Housing and Local Government Ministry.

There is an urgent need to effectively regulate the interest rates and trade terms of non-bank institutions that provide credit to consumers. Very often, the interest rates are exorbitant while the contractual terms are severely unfair to consumers.

Page 80 of 111