FOMCA dedah taktik halus iklan perangkap pengguna

- Details

KUALA LUMPUR - Persekutuan Persatuan-Persatuan Pengguna Malaysia (FOMCA) mendedahkan semakin banyak aduan diterima berhubung taktik halus yang digunakan peniaga untuk memanipulasi pengguna melalui iklan mengelirukan.

KUALA LUMPUR - Persekutuan Persatuan-Persatuan Pengguna Malaysia (FOMCA) mendedahkan semakin banyak aduan diterima berhubung taktik halus yang digunakan peniaga untuk memanipulasi pengguna melalui iklan mengelirukan.

Ketua Pegawai Operasi FOMCA, Nur Asyikin Aminuddin berkata, rakan strategiknya, Pusat Khidmat Aduan Pengguna Nasional (NCCC) juga kerap menerima aduan yang berkaitan dengan amalan perniagaan yang tidak beretika dan segalanya bermula dari sebuah iklan yang mengelirukan.

Menurutnya, iklan sepatutnya digunakan sebagai alat makluman mengenai produk atau perkhidmatan yang ditawarkan, tetapi kini ia dijadikan sebagai perangkap halus untuk memanipulasi pengguna.

"Situasi ini amat membimbangkan kerana ia melibatkan perniagaan daripada pelbagai sektor termasuk pasar raya, kedai serbaneka, e-dagang, telekomunikasi, dan termasuk perkhidmatan kesejahteraan dan kecantikan," katanya dalam kenyataan.

Beliau berkata, sektor kesejahteraan dan kecantikan menunjukkan peningkatan ketara apabila hampir setiap minggu sekurang-kurangnya dua aduan berkaitan iklan mengelirukan diterima.

Terdapat premis yang beroperasi di luar bidang kuasa sama ada Kementerian Kesihatan Malaysia (Ï㽶ÊÓƵ) atau Kementerian Perdagangan Dalam Negeri dan Kos Sara Hidup (KPDN), sekali gus membuka ruang eksploitasi.

Read more: FOMCA dedah taktik halus iklan perangkap pengguna

Tak wajar telco caj hindar scam

- Details

KUALA LUMPUR: Tindakan syarikat telekomunikasi (telco) mengenakan caj RM10 sebulan untuk perkhidmatan perlindungan scam atau penipuan, disifatkan tidak wajar dan bercanggah prinsip tanggungjawab asas penyedia perkhidmatan itu terhadap keselamatan pengguna khidmat mereka.

KUALA LUMPUR: Tindakan syarikat telekomunikasi (telco) mengenakan caj RM10 sebulan untuk perkhidmatan perlindungan scam atau penipuan, disifatkan tidak wajar dan bercanggah prinsip tanggungjawab asas penyedia perkhidmatan itu terhadap keselamatan pengguna khidmat mereka.

Persatuan pengguna dan pakar komputer menyifatkan, keselamatan asas pengguna khidmat telekomunikasi daripada gangguan panggilan dan pesanan sepatutnya ditanggung setiap telco dan bukannya dijadikan sumber keuntungan baharu syarikat berkenaan.

Jabatan Perangkaan Malaysia (DOSM) dalam laporan pada April 2024, mendedahkan 99.3 peratus daripada kira-kira 34 juta rakyat negara ini mempunyai akses kepada telefon bimbit. Ia merangkumi perkhidmatan secara prabayar atau pasca bayar menerusi pelbagai pakej ditawarkan oleh telco tempatan.

Pensyarah Fakulti Sains Komputer dan Matematik Universiti Teknologi MARA (UiTM), Prof Madya Dr Mohamad Yusof Darus, berkata keselamatan digital tidak seharusnya dijadikan produk berbayar, sebaliknya ia hak asas setiap pelanggan yang perlu dijamin oleh semua telco.

"Isunya bukan sekadar pada nilai caj terbabit tetapi pada prinsip adakah keselamatan pengguna suatu pilihan tambahan atau tanggungjawab asas penyedia perkhidmatan.

"Apabila keselamatan dijadikan produk premium, ia seolah-olah menukar perlindungan asas kepada bentuk keuntungan, sedangkan kepercayaan terhadap jaringan komunikasi bergantung kepada jaminan keselamatan yang menyeluruh," katanya kepada BH, semalam.

Fomca sounds alarm over surging insurance premiums

- Details

PETALING JAYA: The Federation of Malaysian Consumers Associations (Fomca) has sounded the alarm over surging private health insurance premiums, adding that many elderly Malaysians are being priced out of protection just when they need it most.

PETALING JAYA: The Federation of Malaysian Consumers Associations (Fomca) has sounded the alarm over surging private health insurance premiums, adding that many elderly Malaysians are being priced out of protection just when they need it most.

Its CEO Dr Saravanan Thambirajah said premiums for policyholders over the age of 60 have surged two to threefold in the past two years, in some cases rising as much as 300%.

âMany retirees who have maintained their policies for decades are now forced to surrender them. Some even sacrifice their own coverage so their children could remain insured.â

He said the trend is deeply worrying, as seniors feel they are being âpunished simply for growing olderâ.

He added that Fomca has seen a growing number of complaints about delayed or rejected claims, excessive red tape and insurers overriding the recommendations of doctors.

âWhen medical decisions are dictated by administrators instead of doctors, the system has failed.

âSome seniors even find it cheaper and less stressful to pay out-of-pocket than to use their insurance.â

Read more: Fomca sounds alarm over surging insurance premiums

EPF withdrawal: Can Malaysia afford to wait beyond 60?

- Details

²Ñ´¡³¢´¡³Û³§±õ´¡âS&²Ô²ú²õ±è;retirement policy has returned to the spotlight after the World Bank proposed raising the Employees Provident Fund (EPF) withdrawal age to beyond 55, citing the countryâs rapidly ageing population and longer life expectancy.

²Ñ´¡³¢´¡³Û³§±õ´¡âS&²Ô²ú²õ±è;retirement policy has returned to the spotlight after the World Bank proposed raising the Employees Provident Fund (EPF) withdrawal age to beyond 55, citing the countryâs rapidly ageing population and longer life expectancy.

In its latest report, âShould Malaysia expand its social pension? Global evidence, design issues and optionsâ, the international financial institution said the current withdrawal age of 55 and social pension eligibility at 60 are no longer in step with Malaysiaâs demographic realities.

It argued that gradually increasing both thresholds would help sustain the countryâs social protection system while allowing retirees to receive larger average benefits later in life.

The World Bank said the proposed shift would better reflect Malaysiaâs demographic profile, with citizens now living longer and healthier than four decades ago, when the current EPF framework was first designed.

Citing data from the Department of Statistics Malaysiaâs (DOSM) 2022 Household Income and Expenditure Survey (HIES), the Bank found that poverty risk rises sharply with age â 24% among households headed by those aged 60 and above, 42% for those 65 and above, and 49% for those 70 and above.

It added that raising the withdrawal and pension eligibility ages would be justified if paired with broader coverage for Malaysians without retirement savings or fixed pensions, to balance welfare needs with fiscal responsibility.

Read more: EPF withdrawal: Can Malaysia afford to wait beyond 60?

Mule accounts reveal deep fault lines in banking

- Details

MALAYSIA is seeing a steady rise in mule account cases, mirroring the broader escalation of online financial scams. The issue cuts across demographics and is becoming a systemic threat to banking integrity and public trust.

MALAYSIA is seeing a steady rise in mule account cases, mirroring the broader escalation of online financial scams. The issue cuts across demographics and is becoming a systemic threat to banking integrity and public trust.

Mule accounts are bank accounts used to receive and transfer illicit funds on behalf of fraud syndicates, obscuring the origin and destination of money. These account holders â some knowingly complicit, others misled through job scams or financial incentives â act as intermediaries in online fraud, investment scams and phishing schemes.

Law enforcement agencies globally, including Europol and Interpol, have identified mule accounts as key enablers of cross-border cybercrime. Young adults and gig workers are frequently targeted due to economic vulnerability and high online exposure.

In Malaysia, the problem has intensified with rising digital banking adoption and the adaptability of criminal networks. At least 1,300 individuals suspected of online fraud were arrested during

Operation Mule, conducted by the National Scam Response Centre (NSRC) over a one-week period ending Sept 28, according to media reports.

The surge has left many victims in prolonged disputes with banks, often facing frozen accounts, limited access to funds and lengthy investigations that affect daily life.

Cadangan naikkan umur persaraan: Akses pengeluaran simpanan KWSP bantu pesara perkukuh kestabilan kewangan

- Details

NATIONAL CONSUMER COMPLAINTS CENTRE (NCCC) AND CONSUMERS ASSOCIATION OF SINGAPORE (CASE) COLLABORATE TO STRENGTHEN CROSS-BORDER CONSUMER PROTECTION

- Details

The National Consumer Complaints Centre (NCCC) today signed a Memorandum of Understanding (MoU) with the Consumers Association of Singapore (CASE) to enhance cooperation in handling cross-border consumer complaints between Malaysia and Singapore.

The National Consumer Complaints Centre (NCCC) today signed a Memorandum of Understanding (MoU) with the Consumers Association of Singapore (CASE) to enhance cooperation in handling cross-border consumer complaints between Malaysia and Singapore.

The MoU was signed by Prof. Emeritus Datuk Dr Marimuthu Nadason, Chairman of NCCC, and Mr. Melvin Yong, President of CASE, in Kuala Lumpur. This landmark agreement establishes a dedicated mechanism to help consumers in both countries resolve disputes amicably when purchasing goods or services across borders.

Under this partnership, a consumer who experiences a dispute while shopping or transacting across the Causeway can now lodge a complaint with their home countryâs consumer body.

- Malaysian consumers with disputes against businesses in Singapore can file their complaints with NCCC, which will refer them to CASE for mediation

- Similarly, Singaporean consumers with disputes against Malaysian businesses can lodge their complaints with CASE, which will refer the case to NCCC for resolution

This cooperation provides consumers a more accessible, transparent, and efficient redress pathway, without the inconvenience of dealing directly with foreign systems.

Budi95 system gets thumbs up from Fomca

- Details

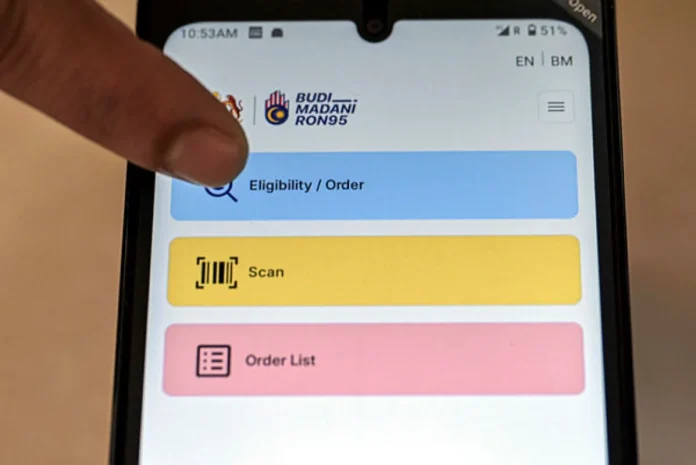

PETALING JAYA: Malaysians are adapting well to the newly implemented Budi95 targeted fuel subsidy system, with most consumers expressing satisfaction with it, said the Federation of Malaysian Consumers Associations (Fomca).

PETALING JAYA: Malaysians are adapting well to the newly implemented Budi95 targeted fuel subsidy system, with most consumers expressing satisfaction with it, said the Federation of Malaysian Consumers Associations (Fomca).

Its CEO Saravanan Thambirajah said feedback from motorists after a month have been largely positive.

âThe overall response to Budi95 has been encouraging. Consumers are adjusting to the new quota system and the MyKad-based verification process is functioning smoothly in most cases.â

Introduced to replace blanket fuel subsidies, Budi95 ensures that assistance reaches those who truly need it while curbing smuggling and misuse.

Most Malaysians now display greater awareness of their fuel usage. Many are planning travel more efficiently, and the quota has proven sufficient for personal and family needs for the vast majority.

Saravanan said Fomca strongly recommends retaining the 300-litre limit, which balances fairness, predictability and fiscal responsibility.

Fomca backs integrating welfare aid through MyKad, urges strong data safeguards

- Details

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) has welcomed the government's proposal to integrate all welfare and aid programmes into the MyKad system, describing it as a positive and timely step towards better governance.

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) has welcomed the government's proposal to integrate all welfare and aid programmes into the MyKad system, describing it as a positive and timely step towards better governance.

"Centralising the data and delivery system can enhance efficiency, coordination, and accountability, ensuring that public assistance reaches those who truly need it," said secretary-general Dr Saravanan Thambirajah when reached by the New Straits Times.

Saravanan cautioned, however, that the system must be underpinned by strong data protection and privacy safeguards to prevent misuse or leaks of personal information.

"Consumers' personal and financial information must be kept secure at all times," he said, adding that while digital integration could bring convenience, it must not compromise trust or fairness.

Saravanan said the initiative could ease the burden faced by vulnerable groups who currently deal with excessive bureaucracy and complicated documentation when applying for aid, reducing administrative hurdles and emotional strain.

He added that integrating data from federal, state, and zakat institutions could also prevent overlapping assistance and ensure fairer resource distribution.

Read more: Fomca backs integrating welfare aid through MyKad, urges strong data safeguards

Page 1 of 111

MAJALAH RINGGIT

ððððððð ððððððð ððððð ððððððð ð²

ðð¢ð¥ ð - ðð®ð¥ðð¢ ðððð

ð

ðððððððð ððð

ð & ððð ðððððððð ððððððð ðððððð ððððððð

ððððððð ððððððð ððððððð adalah usahasama Gabungan Persatuan-Persatuan Pengguna Malaysia (FOMCA) dan Agensi Kaunseling dan Pengurusan Kredit (AKPK) untuk menyampaikan pendidikan kewangan kepada anda.

ð Baca & Muat Turun kesemua edisi RINGGIT melalui pautan:

MAJALAH CEKAP

MAJALAH CEKAP

Edisi 7 - JANUARI 2025

Mahukan tip pengurusan dan kecekapan tenaga?

Dapatkan CEKAP terbitan FOMCA serta Tenaga Nasional Berhad (TNB) untuk rujukan anda.

Baca & Muat Turun kesemua edisi CEKAP melalui pautan di bawah:

MAJALAH GENERASI PENGGUNA

MAJALAH GENERASI PENGGUNA

EDISI 2024

Mahukan tip dan maklumat pengurusan kewangan?

Dapatkan majalah GENERASI PENGGUNA terbitan FOMCA serta KEMENTERIAN PERDAGANGAN DALAM NEGERI DAN KOS SARA HIDUP (KPDN) untuk rujukan anda.

Aduan Pengguna

03-7877 9000 / 03-7877 1076

NCCC - Pusat aduan setempat bagi membantu para pengguna menyelesaikan masalah dan aduan pengguna

Most Read Posts

Traffic