(ENG) FOMCA PRESS RELEASE: TRANSPARENCY IN PRIVATE HEALTHCARE - A PRESCRIPTION LONG OVERDUE

- Details

DATE OF RELEASE: 8th AUGUST 2025

Dear Editor,

Dear Editor,

PRESS RELEASE: TRANSPARENCY IN PRIVATE HEALTHCARE - A PRESCRIPTION LONG OVERDUE

The governmentโs move to mandate prescription issuance and transparent, itemised billing in private healthcare facilities deserves not just recognition but wholehearted support. Malaysia has long operated a dual-tier healthcare system: the public sector, heavily subsidised and accessible, coexists with a private, market-driven sector where out-of-pocket payments continue to dominate. In fact, nearly half of all healthcare spending comes directly from patientsโ pocketsโabout 35โฏpercent is out-of-pocketโunderscoring how vulnerable consumers are in this landscape.

On a macroeconomic scale, Malaysiaโs medical cost inflation has surged to 12.6โฏpercent in 2023โdouble the global average of 5.6โฏpercentโsignificantly driven by unchecked private-sector charges . Bank Negara has emphasized that enhanced pricing transparency, including public drug and procedure prices and itemised billing, is pivotal in curbing this escalation and shielding consumers.

Micro-level data tell an even more alarming story. A trusted study revealed that medicines for everyday conditions can cost patients the equivalent of several daysโ wages. For example, private sector prices for certain antihypertensive could cost 2.3 days of pay for innovator brands, while generics still cost half a day to a full dayโs wageโa serious burden for low-income earners . In some clinics, generic drug markups exceeded 100โฏpercent, meaning the cost of essential treatment was doubled by unseen profit margins.

Against this backdrop, requiring private clinics and pharmacies to issue a prescription alongside a detailed billโlisting consultation fees, drug names and prices, procedures, and materialsโempowers patients with the knowledge to compare prices or seek more affordable outlets. It dismantles the information asymmetry that has long allowed profiteering under the guise of medical convenience. Studies show that if drug price caps were introduced, patients could realize savings of 40โ50โฏpercent on medicine costsโagain demonstrating how much hidden room there is for fairer pricing.

Tax or total ban on vape products?

- Details

PETALING JAYA: The recent revelation that the government may expand pro-health tax by taxing vape, tobacco and alcohol products has raised an eyebrow among activists, with concerns emerging that the proposal to ban vape may falter.

PETALING JAYA: The recent revelation that the government may expand pro-health tax by taxing vape, tobacco and alcohol products has raised an eyebrow among activists, with concerns emerging that the proposal to ban vape may falter.

Anti-smoking crusaders are now demanding answers from the government on whether it will eventually move to ban vape, or just tax the substance, with Consumers Association of Penang (CAP) education officer NV Subbarow querying the recent announcement under the 13th Malaysia Plan (13MP).

โI am totally confused. What is the point of imposing tax on vape products?

โThe Health Minister must immediately clarify the governmentโs position on banning vape and e-cigarettes,โ he said, emphasising CAPโs support for a total ban.

Subbarow said the government could instead impose higher taxes on cigarettes and alcohol to reduce non-communicable diseases.

โThe Finance Ministry must clarify the tax on vape,โ said the anti-smoking activist, who argued that vape will lead to addiction problems that the government will have to deal with, including that of drug-laced vapes.

โTrade deal unlikely to ease cost of livingโ

- Details

PETALING JAYA: The reduction in US tariffs on Malaysian exports is a win for trade, but it would not ease the cost of living for consumers anytime soon, said the Federation of Malaysian Consumers Association (Fomca).

PETALING JAYA: The reduction in US tariffs on Malaysian exports is a win for trade, but it would not ease the cost of living for consumers anytime soon, said the Federation of Malaysian Consumers Association (Fomca).

Its president Dr Saravanan Thambirajah pointed out that domestic policies, not foreign tariffs, are what shape household expenses.

He said the cut from 25% to 19% would boost export competitiveness and job stability but any relief for consumers would be indirect and gradual.

โThe US tariff cut on Malaysian exports is mainly a trade move, with little direct effect on prices of domestic goods since it applies to exports, not imports,โ he told theSun.

โAs such, Malaysian consumers are unlikely to see an immediate drop in retail prices. But if it helps exporters maintain or grow market share, the resulting stability in jobs and incomes could indirectly support purchasing power over time.โ

Saravanan said key cost-of-living pressures โ food, housing, energy and transport โ are driven by domestic policies, commodity prices and currency strength, not external tariffs.

โNuclear energy can waitโ

- Details

Govt should invest in other sustainable options first, say groups

Govt should invest in other sustainable options first, say groups

PETALING JAYA: Malaysia should focus on developing safer, sustainable sources of energy production before even considering nuclear power, say interest groups.

โWhile nuclear energy is often classified as clean based on greenhouse gas emissions, this assessment overlooks other critical environmental parameters like radioactivity, toxicity and long-term environmental impact.

โWhen we measure nuclear energy together with these environmental parameters, we will see that it is not as clean as claimed by certain parties,โ he said, adding that public acceptance of nuclear energy is low.

The 13th Malaysia Plan (13MP), which was unveiled on Thursday, stated that the government was considering the possibility of introducing nuclear energy as a clean energy source.

It also pointed out that the government would focus on developing and upgrading sustainable energy production infrastructure across the country, which include hydrogen hubs in Terengganu and east Malaysia.

FOMCA sambut baik pengumuman PMX, dapat ringankan kos sara hidup

- Details

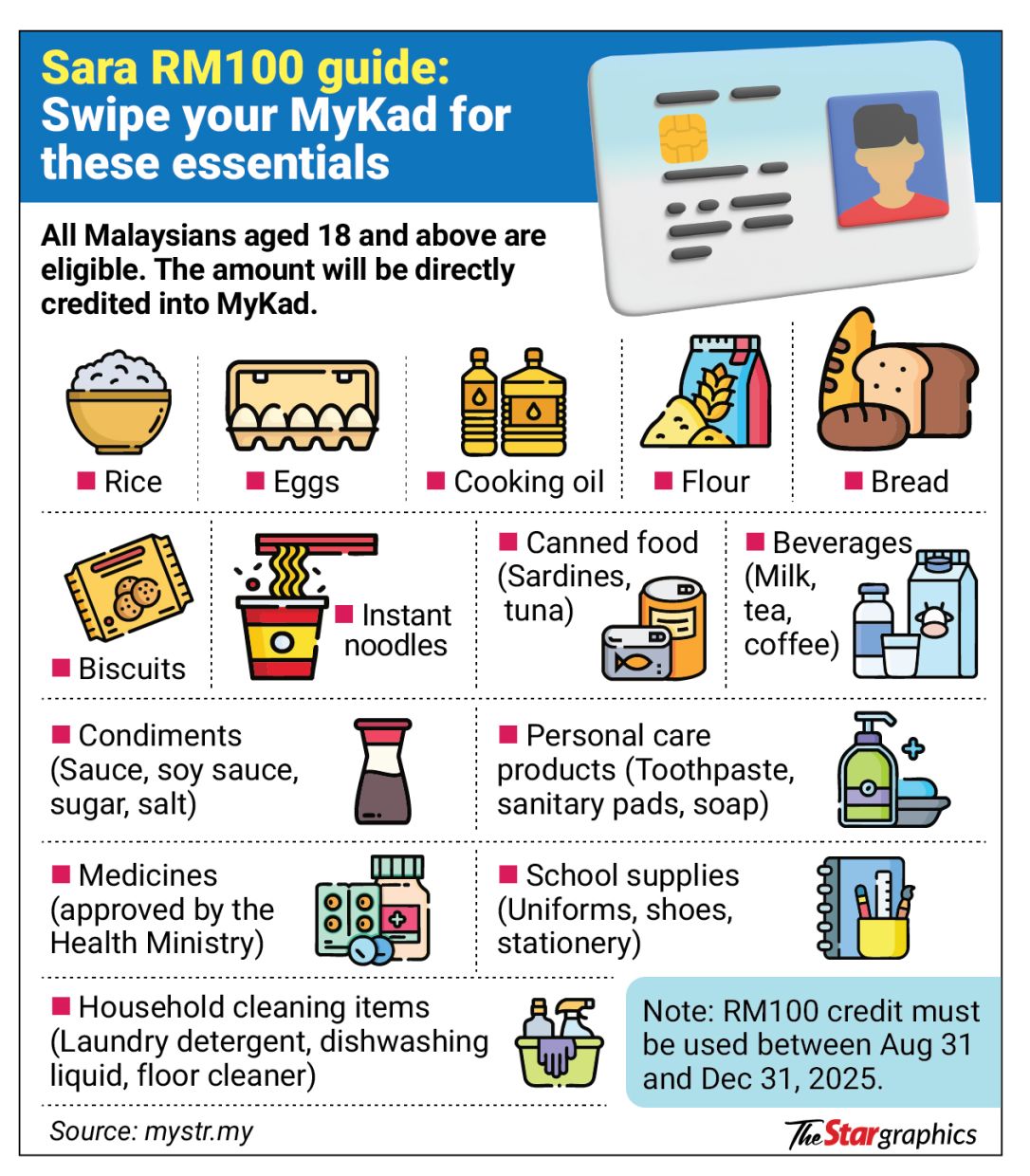

Gabungan Persatuan Pengguna Malaysia (FOMCA) mengalu-alukan pengumuman oleh Perdana Menteri Anwar Ibrahim khususnya perluasan bantuan tunai Sumbangan Asas Rahmah (SARA) kepada semua warganegara dewasa berumur 18 tahun ke atas.

Gabungan Persatuan Pengguna Malaysia (FOMCA) mengalu-alukan pengumuman oleh Perdana Menteri Anwar Ibrahim khususnya perluasan bantuan tunai Sumbangan Asas Rahmah (SARA) kepada semua warganegara dewasa berumur 18 tahun ke atas.

Ketua Pegawai Eksekutif FOMCA, Dr Saravanan Thambirajah berkata pemberian tunai sekali bayar RM100 mulai 31 Ogos ini melalui MyKad dan boleh dibelanjakan di lebih 4,100 premis runcit itu sudah tentu memberi manfaat kepada kira-kira 22 juta rakyat Malaysia.

โPemberian ini mengiktiraf realiti semasa bahawa tekanan kos sara hidup bukan lagi isu golongan berpendapatan rendah saja, malah turut membelenggu kumpulan pertengahan.

โFOMCA menyambut baik pelbagai inisiatif diumumkan Perdana Menteri hari ini yang dapat meringankan beban kos sara hidup rakyat termasuk pemberian bantuan tunai RM100 secara one-off, penurunan harga petrol RON95, pembekuan kadar tol serta peluasan program Jualan Rahmah Madani,โ katanya dipetik laporan BH.

Mengulas penurunan harga petrol RON95 kepada RM1.99 seliter, FOMCA menyifatkan ia sebagai langkah yang memberi impak langsung kepada berjuta pengguna, khususnya pekerja muda dan komuniti ekonomi gig.

Read more: FOMCA sambut baik pengumuman PMX, dapat ringankan kos sara hidup

Perluasan bantuan tunai langkah inklusif yang tepat- FOMCA

- Details

KUALA LUMPUR: Langkah kerajaan memperluaskan bantuan tunai Sumbangan Asas Rahmah (SARA) kepada semua warganegara dewasa berumur 18 tahun ke atas tanpa mengira tahap pendapatan satu usaha inklusif yang tepat pada masanya.

KUALA LUMPUR: Langkah kerajaan memperluaskan bantuan tunai Sumbangan Asas Rahmah (SARA) kepada semua warganegara dewasa berumur 18 tahun ke atas tanpa mengira tahap pendapatan satu usaha inklusif yang tepat pada masanya.

Ketua Pegawai Eksekutif Gabungan Persatuan Pengguna Malaysia (FOMCA), Dr Saravanan Thambirajah, berkata bantuan yang akan diagihkan mulai 31 Ogos ini melalui MyKad dan boleh dibelanjakan di lebih 4,100 premis runcit itu sudah tentu memberi manfaat kepada kira-kira 22 juta rakyat Malaysia.

"Pemberian ini mengiktiraf realiti semasa bahawa tekanan kos sara hidup bukan lagi isu golongan berpendapatan rendah saja, malah turut membelenggu kumpulan pertengahan,"

"FOMCA menyambut baik pelbagai inisiatif diumumkan Perdana Menteri hari ini yang dapat meringankan beban kos sara hidup rakyat termasuk pemberian bantuan tunai RM100 secara one-off, penurunan harga petrol RON95, pembekuan kadar tol serta peluasan program Jualan Rahmah Madani," katanya ketika ditemui BH, hari ini.

Mengulas penurunan harga petrol RON95 kepada RM1.99 seliter, FOMCA menyifatkan ia sebagai langkah yang memberi impak langsung kepada berjuta pengguna, khususnya pekerja muda dan komuniti ekonomi gig.

Read more: Perluasan bantuan tunai langkah inklusif yang tepat- FOMCA

Whatโs next after one-off cash aid?

- Details

PETALING JAYA: The special targeted relief announced by Prime Minisยญter Datuk Seri Anwar Ibrahim must be complemented by long-term strategies to support those in need, says the Federation of Malaysian Consumers Assoยญciaยญtions (Fomca).

PETALING JAYA: The special targeted relief announced by Prime Minisยญter Datuk Seri Anwar Ibrahim must be complemented by long-term strategies to support those in need, says the Federation of Malaysian Consumers Assoยญciaยญtions (Fomca).

Its vice-president Datuk Indrani Thuraisingham said while Fomca welcomes the measures, including the one-off RM100 cash assistance for eligible individuals and the adjustment of RON95 ceiling price, the impact of such initiatives remains limited due to its one-time nature and the escalating cost of basic goods and services.

โIn the long term, Malayยญsia needs a more resilient and inclusive economic model that puts the welfare of ordinary consumers at the centre of policyยญ-making.

โWhile short-term aid is necessary during times of economic uncertainty, it must be complemented by structural reforms that reduce cost burdens, protect vulnerable groups including the lower middle class segments, and ensure a fairer distribution of national wealth,โ she said when contacted yesterday.

Yesterday, Anwar announced several key initiatives as part of the Madani governmentโs appreciation for the people, including a one-off RM100 Sara aid via MyKad for all Malaysian adults, postponement of toll rate hikes for 10 highways, and a lower subsidised RON95 petrol price of RM1.99 per litre.

Kathleen Chem, an associate director in Fitch Ratingsโ Soveยญreigns team, said: โFitch estimates the total cost of these measures at RM2.3bil, or about 0.1% of GDP, which we believe can be accommodated within the Budget 2025 target of 3.8% of GDP.

Fomca welcomes RM100 one-off aid, urges stronger price control and wise spending

- Details

GEORGE TOWN: The Federation of Malaysian Consumers Associations (Fomca) has welcomed the series of initiatives announced by Prime Minister Datuk Seri Anwar Ibrahim aimed at easing the cost of living burden for Malaysian consumers.

GEORGE TOWN: The Federation of Malaysian Consumers Associations (Fomca) has welcomed the series of initiatives announced by Prime Minister Datuk Seri Anwar Ibrahim aimed at easing the cost of living burden for Malaysian consumers.

These include the one-off RM100 cash assistance under the Sumbangan Asas Rahmah (Sara) programme, the reduction in RON95 petrol prices, the decision to maintain current toll rates across major highways, and the expanded reach of the Jualan Rahmah Madani programme.

Its chief executive officer Dr Saravanan Thambirajah, said Fomca viewed the RM100 one-off assistance as a timely and inclusive step, especially given the persistent pressure of food prices despite the overall inflation rate remaining low.

"The government's move to extend this assistance to all adult citizens aged 18 and above, regardless of income level, is unprecedented and signals recognition that the cost-of-living crisis is affecting not just the lower-income group but also the middle class.

"This broad-based approach is commendable and shows the government's responsiveness to the realities on the ground," he told the New Straits Times.

Read more: Fomca welcomes RM100 one-off aid, urges stronger price control and wise spending

FOMCA calls for tougher action on electricity theft amid RM4.8 billion losses

- Details

ELECTRICITY theft in Malaysia must be treated as a major economic and criminal issue, not merely a technical violation, said the Federation of Malaysian Consumers Associations (FOMCA), following revelations of RM4.8 billion in losses linked to illegal bitcoin mining activities between 2018 and mid-2024.

ELECTRICITY theft in Malaysia must be treated as a major economic and criminal issue, not merely a technical violation, said the Federation of Malaysian Consumers Associations (FOMCA), following revelations of RM4.8 billion in losses linked to illegal bitcoin mining activities between 2018 and mid-2024.

FOMCAโs chief executive officer, Dr T. Saravanan, called for immediate and decisive action from the government, regulators and Tenaga Nasional Berhad (TNB), including the adoption of smart technologies such as real-time monitoring and data analytics to detect unusual electricity usage.

โEnforcement efforts must be intensified, not only targeting the operators of illegal mining farms but also extending legal accountability to landlords, enablers and financiers who profit from or facilitate these activities,โ he said in a statement.

Dr Saravanan stressed the need for urgent reform of existing laws to ensure penalties are proportional to the scale of the offence.

Read more: FOMCA calls for tougher action on electricity theft amid RM4.8 billion losses

Dewan Rakyat lulus RUU Kredit Pengguna 2025, suruhanjaya pantau sektor kredit tidak terkawal secara berfasa

- Details

KUALA LUMPUR: Rang Undang-Undang (RUU) Kredit Pengguna 2025 yang bertujuan melindungi kepentingan pengguna kredit di negara ini mendapat kelulusan Dewan Rakyat hari ini.

RUU itu dibentangkan bagi bacaan kali kedua dan ketiga oleh Timbalan Menteri Kewangan, Lim Hui Ying hari ini dan dibahaskan 23 Ahli Parlimen.

Menurut Hui Ying, sebaik sahaja diwartakan, RUU itu akan memperkenalkan pengawalseliaan bersepadu secara berperingkat, mengambil kira tahap kesiapsiagaan industri serta keupayaan Suruhanjaya Kredit Pengguna yang akan ditambah baik secara berfasa.

Katanya, suruhanjaya itu akan melaksanakan tugas pengawalseliaan secara berperingkat, bermula dengan penyedia kredit yang kini tidak berada di bawah seliaan mana-mana pihak berkuasa, sebelum pemusatan sepenuhnya dijangka berlaku menjelang tahun 2031.

"Fasa pertama akan menyaksikan suruhanjaya mengawal selia semua perniagaan kredit dan penyedia perkhidmatan kredit yang tidak dikawal selia ketika ini.

Page 4 of 111