INTERACTIVE: Expand B40 health schemes to M40 households, say stakeholders

- Details

PETALING JAYA: Free health screenings and subsidised medical insurance for the B40 should be widened to include middle-income families who are also feeling the pinch from rising medical inflation, say stakeholders.

PETALING JAYA: Free health screenings and subsidised medical insurance for the B40 should be widened to include middle-income families who are also feeling the pinch from rising medical inflation, say stakeholders.

Federation of Malaysian Consumers Associations (FOMCA) chief executive officer Saravanan Thambirajah said many M40 households now face similar financial pressures as the B40, including higher medical costs, stagnant wages, and limited access to affordable private healthcare.

โThey are the โmissing middleโ who fall through the cracks of social protection.

โBy widening coverage through a shared-subsidy or co-payment model, the government can ensure more Malaysians are protected against unexpected medical expenses while keeping the schemes financially sustainable,โ he said.

He said this in response to Aonโs 2026 Global Medical Trend Rates Report which projects Malaysiaโs medical inflation to hit 16% in 2026, well above the Asia-Pacific average of 11.3%.

Current health programmes for the B40 include Peka B40, which offers free check-ups, medical device aid, and early detection incentives for Malaysians aged 40 and above.

Read more: INTERACTIVE: Expand B40 health schemes to M40 households, say stakeholders

Govt urged to maintain speed limiter deadline

- Details

PETALING JAYA: Road safety experts have urged the government to hold firm to its October enforcement deadline for speed limiter devices on heavy vehicles, warning that poorly maintained lorries and buses pose a grave risk to public safety.

PETALING JAYA: Road safety experts have urged the government to hold firm to its October enforcement deadline for speed limiter devices on heavy vehicles, warning that poorly maintained lorries and buses pose a grave risk to public safety.

They cautioned that delays could lead to tragedies such as the Universiti Pendidikan Sultan Idris (UPSI) bus crash, and called for stiff penalties โ including fines higher than compliance costs and the immediate impounding of unchecked vehicles โ to ensure operators take the rules seriously.

Road safety expert Dr Law Teik Hua said voluntary compliance has been alarmingly low, with fewer than 3,000 vehicles verified in the past three months.

โGiven the risks posed by unchecked heavy vehicles, there is a strong case for zero tolerance after the October deadline,โ he said when contacted yesterday.

Law warned that postponing enforcement will undermine both safety and the credibility of the authorities.

Nuclear ambitions demand caution, clarity, and public accountability

- Details

THE recent announcement that Malaysia could introduce nuclear power within the next decade has triggered a wave of discussion. Some see nuclear energy as a bold step forward in diversifying our energy mix, while others fear that it is a costly gamble with consequences that could last for generations.

THE recent announcement that Malaysia could introduce nuclear power within the next decade has triggered a wave of discussion. Some see nuclear energy as a bold step forward in diversifying our energy mix, while others fear that it is a costly gamble with consequences that could last for generations.

The truth is that this issue cannot be reduced to slogans about โclean energyโ or โfuture security.โ It demands a sober, honest, and transparent national conversation that goes beyond promises to examine the full reality of what nuclear means for Malaysia.

Malaysia has pledged under its National Energy Transition Roadmap (NETR) and broader climate policies to achieve Net Zero by 2050. At the macro level, this is not optional; it is a global responsibility.

Nuclear power, in theory, offers low-carbon electricity that can complement solar and wind by providing steady, baseload supply. In a future where Malaysiaโs demand will not only rise with population growth but also with the rapid expansion of data centres, electric vehicles, and high-energy industries, the allure of nuclear is understandable.

Reliable power is the backbone of a modern economy, and the argument is often made that renewables alone may struggle to keep up with demand, especially during cloudy days or windless nights. Proponents believe nuclear could provide the โalways-onโ stability to balance renewables in the grid.

Read more: Nuclear ambitions demand caution, clarity, and public accountability

MyDigital ID plan for prepaid cards sparks privacy debate

- Details

PETALING JAYA: Malaysiaโs push to link prepaid SIM registration with MyDigital ID is viewed as a crucial step to combat rampant scams; however, some experts express concerns it could undermine consumer privacy.Malaysian Cyber Consumer Association (MCCA) president Siraj Jalil said they have been advocating for this initiative since January.

PETALING JAYA: Malaysiaโs push to link prepaid SIM registration with MyDigital ID is viewed as a crucial step to combat rampant scams; however, some experts express concerns it could undermine consumer privacy.Malaysian Cyber Consumer Association (MCCA) president Siraj Jalil said they have been advocating for this initiative since January.

โWe urged the government not only to reform prepaid SIM registration with MyDigital ID but also to track down the supply chain where registered SIM cards are sold illegally.

โThis initiative by the government is crucial, as scammers widely use registered SIM cards to conduct their illegal operations,โ said Siraj.

On Wednesday, Communicaยญtions Minister Datuk Fahmi Fadzil announced that all telecommunications companies in the country would be instructed to implement MyDigital ID in the prepaid SIM registration ยญprocess.

Fahmi said the policy would be enforced by the end of the year.

The measure, he added, would close loopholes in the existing system and prevent any potential misuse.

Read more: MyDigital ID plan for prepaid cards sparks privacy debate

BUDI95: MyKad readers to be installed at all petrol stations, pump terminals to ease process, says Finance Ministry

- Details

IPOH: MyKad readers will be set up at all petrol stations and pump terminals to ease the process for the people to benefit from the Budi Madani RON95 (BUDI95) programme, which starts this Saturday (Sept 27).

IPOH: MyKad readers will be set up at all petrol stations and pump terminals to ease the process for the people to benefit from the Budi Madani RON95 (BUDI95) programme, which starts this Saturday (Sept 27).

The Finance Ministry, in a statement Monday (Sept 22), said that those eligible for targeted subsidised RON95 would only need to verify using their MyKad without any registration process.

"The MyKad readers will be available at the stations and pump terminals to reduce the risk of congestion.

"Another option is through Touch'N Go (TnG) e-wallet or mobile apps like Setel by Petronas and CaltexGo," the statement said.

Prime Minister Datuk Seri Anwar Ibrahim had earlier announced the price of RON95 would be reduced to RM1.99 per litre from RM2.05 per litre, through the BUDI95 programme.

Fomca backs multi-option RON95 subsidy system to ease consumer concerns

- Details

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) welcomes the government's assurance that multiple mechanisms will be available for payment of subsidised RON95 petrol, calling it a move that balances foresight and consumer needs.

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) welcomes the government's assurance that multiple mechanisms will be available for payment of subsidised RON95 petrol, calling it a move that balances foresight and consumer needs.

Its secretary-general Dr Saravanan Thambirajah said the announcement by the Domestic Trade and Cost of Living Ministry is a timely move that demonstrates foresight and will reduce public worry.

He said offering consumers a choice of multiple options would ensure a backup if one system fails and help prevent long queues, disputes or outright denial of subsidy to eligible consumers.

"The most consumer-friendly approach is one that prioritises convenience, security and reliability," he told the 'New Straits Times' today.

Saravanan added that the ministry's proactive step would reassure the public that the government is listening to consumer concerns if it is done comprehensively.

"As long as these mechanisms are implemented with strong data protection, strict enforcement against misuse, and clear standard operating procedures (SOPs) at petrol stations, consumers can have confidence that the subsidy will be delivered fairly, efficiently, and without compromising their rights or security," he said.

Read more: Fomca backs multi-option RON95 subsidy system to ease consumer concerns

Rising costs of food and goods threat to tourism

- Details

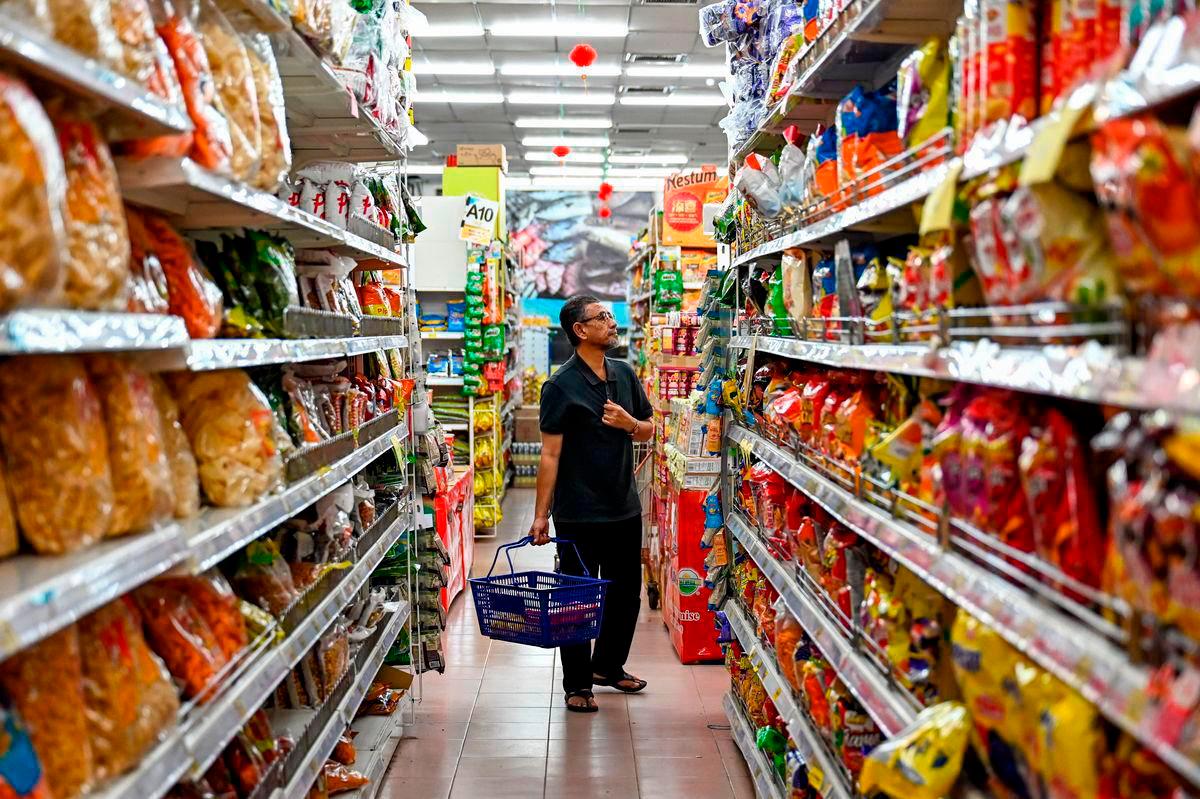

PETALING  JAYA: Malaysiaโs reputation as a value-for-money destination could be at stake ahead of Visit Malaysia Year 2026 with rising food and goods prices at tourist hotspots threatening to deter travellers and deepen resentment among locals.

JAYA: Malaysiaโs reputation as a value-for-money destination could be at stake ahead of Visit Malaysia Year 2026 with rising food and goods prices at tourist hotspots threatening to deter travellers and deepen resentment among locals.

Federation of Malaysian Consumers Associations (Fomca) CEO Dr Saravanan Thambirajah said inflated prices in popular tourist areas carry a โdouble burdenโ, which means tourists are shocked by the cost while locals struggle because they depend on the same shops, restaurants and markets for essentials.

He said locals, particularly those from lower and middle income households, are hit hardest as many spend nearly 40% of their income on food and daily necessities.

โIn certain tourism-heavy towns, the price of a meal or groceries could be up to 30% higher than in non-tourist districts. Residents then face the unfair choice of paying inflated rates or travelling elsewhere for affordable goods.โ

He also said Fomca and the National Consumer Complaints Centre have received numerous reports from locals in such areas.

He added that the most common grievances were food and beverages priced two or three times higher than in surrounding towns, and basic goods such as bottled water, snacks and household items being sold at unjustifiable mark-ups.

SHAPING CONSUMER JOURNEYS WHERE BUSINESS ACCOUNTABILITY MEETS CONSUMER TRUST AND SUSTAINABILITY

- Details

โURA must protect, not risk ownersโ

- Details

PETALING JAYA: There should be greater houseowner protection, transparency, and a reduction in ministerial power to prevent potential misuse and ensure fair treatment of property owners in the implementation of the proposed Urban Renewal Act (URA), say stakeholders.

PETALING JAYA: There should be greater houseowner protection, transparency, and a reduction in ministerial power to prevent potential misuse and ensure fair treatment of property owners in the implementation of the proposed Urban Renewal Act (URA), say stakeholders.

The Federation of Malaysian Consumers Associations (Fomca) vice-preยญsident Datuk Indrani Thuraiยญsingยญham said redevelopment needs must be balanced with fairness, transparency, and sustainability.

โWithout robust consumer safeguards, urban renewal risks displacing vulnerable communities and undermining public trust,โ she said in an interview yesterday.

Indrani said that the legislation, recently tabled for its first reading in Parliament, lacks provisions to prevent displacement without secuยญre, affordable rehousing options.

โVulnerable groups, such as the elderly and low-income households, are particularly at risk. Renewal should preserve community bonds and cultural heritage, not destroy them,โ she added.

RM100 SARA aid meaningful if spent wisely, says FOMCA

- Details

KUALA LUMPUR: The one-off RM100 Basic Rahmah Contribution for every Malaysian citizen aged eighteen and above can have a meaningful impact if used wisely.

KUALA LUMPUR: The one-off RM100 Basic Rahmah Contribution for every Malaysian citizen aged eighteen and above can have a meaningful impact if used wisely.

Federation of Malaysian Consumers Associations chief operating officer Nur Asyikin Aminuddin said the initiative can help ease the peopleโs burden in purchasing daily essentials.

She stated that the governmentโs initiative through the MyKasih programme deserves recognition as it offers a wide range of basic goods at prices significantly lower than usual.

โWith RM100, people can not only purchase essential goods in larger quantities but also enjoy meaningful savings through the MyKasih programme,โ she said in a statement.

Nur Asyikin added that the RM100 assistance also stimulates the local economy, benefiting not only recipients but also supporting the countryโs overall economic cycle.

Read more: RM100 SARA aid meaningful if spent wisely, says FOMCA

Page 2 of 111