i-Citra online application opens July 15

- Details

June 28, 2021 @ 7:20pm

June 28, 2021 @ 7:20pm

KUALA LUMPUR: The Employees' Provident Fund (EPF) members may apply for the newly-announced withdrawal scheme, i-Citra beginning July 15.

It said that applications can be made via the i-Citra online portal at icitra.kwsp.gov.my and the payments would be credited in the respective members' accounts in August this year.

"All members below the age of 55 are eligible to apply for i-Citra, which allows them to withdraw up to a maximum of RM5,000 subject to their total combined balance in both Accounts 1 and 2.

"The approved withdrawal amount will be paid for a period of up to five months, with a fixed monthly payment of RM1000 per month subject to savings balance and a minimum of RM50.

"An updated mobile number to receive the Transaction Authorisation Code (TAC) and an active personal bank account are required to facilitate the application process," it said in a statement issued by EPF's corporate affairs department today.

It was responding to the announcement made by Prime Minister Tan Sri Muhyiddin Yassin during a special address.

EPF said it supports the government's initiative to address the needs of Malaysians impacted by the pandemic by introducing the i-Citra withdrawal facility to help its members tide over the impact of the Movement Control Order (MCO) in the short-term.

"i-Citra is being introduced in response to the challenges that EPF members are facing and was developed after careful consideration on how best to assist affected members, while upholding the EPF mandate."

It said while EPF remained committed to safeguarding members' retirement funds, it acknowledged the need to balance current demands against future needs and facilitate temporary relief for members amid the Covid-19 pandemic.

For further information, members may refer to the EPF website at www.kwsp.gov.my, or contact i-Citra Hotline at 03-8922 4848.

6-month bank loan moratorium for individuals, micro entrepreneurs

- Details

June 28, 2021 @ 5:49pm

June 28, 2021 @ 5:49pm

KUALA LUMPUR: A six-month bank loan moratorium will be granted to all individual borrowers and micro-entrepreneurs to help them weather the economic effects of the Covid-19 pandemic.

Prime Minister Tan Sri Muhyiddin Yassin, in unveiling the Pakej Perlindungan Rakyat dan Pemulihan Ekonomi (Pemulih) assistance programme today, said the moratorium will be given to all individuals, regardless of their income bracket, and would be approved automatically after application.

"There will be no conditions such as income reduction, no checks whether you have lost your job, and no need for documentation to be submitted for application (of the moratorium).

"You will only need to apply, and approval will be given automatically," he said in a special televised address this evening.

This facility, he said, would also be offered to affected small and medium enterprise (SME) operators, subject to review and scrutiny by the bank, with applications opening from July 7.

"Borrowers would only need to apply and sign an agreement to amend the relevant loan terms," said Muhyiddin.

He said since the introduction of the Pemerkasa Plus package, over 250,000 eligible borrowers have had their moratorium applications automatically approved to date, only having to choose between a three-month moratorium or a 50 per cent reduction in installment payments for six months.

The government, he said, understands the concerns of the people at this time, adding that many who were affected do not only come from the B40 group.

"I have heard and read many similar grievances from the M40 and T20 groups who have more dependents, as they are also helping family members or relatives affected by Covid-19."

He hoped the moratorium would help individual and SME loan borrowers in managing their cash flow throughout this challenging time.

"However, I would also like to advise you to make proper use of this moratorium offer, and if not urgent, do not make additional financial commitments."

Source:

CTOS offers free credit report with CCRIS for consumers

- Details

June 28, 2021 @ 4:37pm

June 28, 2021 @ 4:37pm

KUALA LUMPUR: Credit reporting agency CTOS Data Systems Sdn Bhd is offering free MyCTOS reports together with Central Credit Reference Information System (CCRIS) data for consumers as part of a nationwide financial empowerment campaign.

In a statement today, it said the free service would encourage more people to take the first step towards managing their financial health.

It added that there has been a 52 per cent increase in consumers accessing CTOS credit reports over the past 12 months, and a recent survey showed that 57 per cent of consumers checked their credit due to financial issues caused by the pandemic.

Chief executive officer Eric Chin said Covid-19 and its uncertainties have highlighted the urgent need for Malaysians to get on top of their financial health.

"However, based on our data, only around 1.3 million out of the approximately 15 million working population in Malaysia perform self-checks to access and manage their personal credit information," he said.

He said CTOS aims to empower as many people as possible with the right tools and knowledge to make good financial decisions, especially in the current challenging times when it matters most.

According to the agency, the report contains detailed information about a person's debt, account histories for credit cards and loans such as payment history, including any late payments, credit limits or loan amounts, account balances and credit enquiries.

"Legal cases and bankruptcies are also listed in a separate section of the credit report as well as directorships and business interests," it said.

The free MyCTOS report with CCRIS campaign is available through www.ctoscredit.com.my as part of the CTOSCARES initiative until July 31, 2021. -- Bernama

Source:

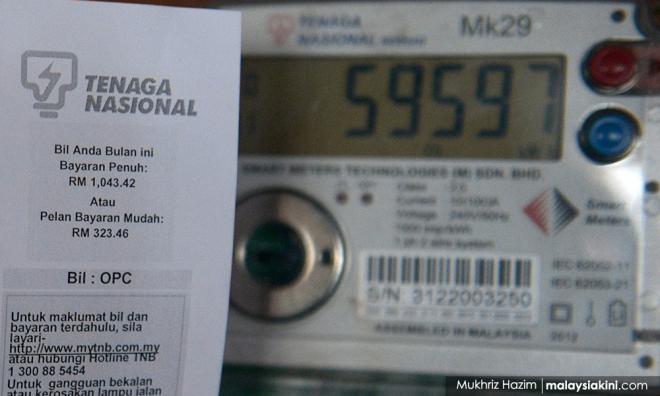

Tiada kenaikan tarif elektrik bagi tahun ini, kekal 39.45 sen/kWj

- Details

28 Jun 2021, 11:15 am

28 Jun 2021, 11:15 am

Tiada kenaikan tarif asas elektrik bagi tempoh 1 Julai sehingga 31 Dis depan setelah kerajaan bersetuju membiayai pemberian rebat sebanyak dua sen/kWj melibatkan peruntukan RM493 juta.

Menteri Tenaga dan Sumber Asli Datuk Seri Dr Shamsul Anuar Nasarah berkata pemberian rebat melalui peruntukan dana Kumpulan Wang Industri Elektrik (KWIE) itu menjadikan tarif asas elektrik kekal pada kadar 39.45 sen/kWj dan dianggarkan seramai 9.44 juta pengguna akan terus menikmati rebat tersebut.

Beliau berkata selaras dengan pelaksanaan mekanisme penetapan tarif elektrik di Semenanjung yang dilaksanakan sejak 2014, pelarasan kos penjanaan elektrik perlu dilaksana setiap enam bulan melalui mekanisme Pelepasan Kos Tidak Seimbang (ICPT) dan bagi tempoh 1 Julai hingga 31 Dis 2021, kos ICPT perlu diselaraskan berjumlah RM638.98 juta.

โPeningkatan kos ICPT berlaku berikutan peningkatan kos pembekalan gas dan arang batu bagi tempoh Januari hingga Jun 2021. Ini bermakna kadar rebat elektrik yang boleh dilepaskan kepada pengguna ialah sebanyak 1.13 sen/kWj berbanding kadar rebat bagi tempoh Januari hingga Jun 2021 iaitu dua sen/kWj.

โMengambil kira cabaran dan kesukaran dihadapi rakyat berikutan pelaksanaan Perintah Kawalan Pergerakan bagi mengekang penularan COVID-19, kerajaan bersetuju membiayai pemberian rebat tambahan 0.87 sen/kWj agar tidak berlaku kenaikan tarif elektrik dan mengekalkan sebagaimana sekarang,โ katanya pada sidang media secara maya mengenai tarif elektrik hari ini.

Beliau berkata pemberian rebat tambahan itu membolehkan semua pemilik akaun Tenaga Nasional Berhad (TNB) menikmati purata diskaun sebanyak lima peratus bagi tempoh tersebut (1 Jul hingga 31 Dis 2021).

Shamsul Anuar berkata bagi pengguna di Kulim High Technology Park (KHTP) yang mendapat bekalan elektrik daripada NUR Power Sdn. Bhd, kerajaan juga bersetuju untuk memberi rebat elektrik sebanyak dua sen/kWj kepada pengguna bukan domestik bagi tempoh 1 Julai hingga 31 Dis 2021.

โIni kali pertama pengguna bukan domestik di KHTP menikmati rebat elektrik sejak mekanisme penetapan tarif Incentive-Based Regulations dilaksanakan pada 2017.

Read more: Tiada kenaikan tarif elektrik bagi tahun ini, kekal 39.45 sen/kWj

Empowering Consumers through Energy Literacy

- Details

Energy is a very critical part and parcel of our daily lives. We use it for lighting our homes, cooking food, playing music, powering a wide range of appliances and for many other personal and household purposes.

Energy is a very critical part and parcel of our daily lives. We use it for lighting our homes, cooking food, playing music, powering a wide range of appliances and for many other personal and household purposes.

However, excessive consumption of energy is both expensive and harmful to the environment. When we use excessive energy, a lot of waste is released to the environment. Coal and fossil fuels are often burnt to produce energy and in the process, different kinds of gases and residual particles are emitted to the environment. If these emissions are not controlled, these toxins can pollute the environment and affect our health as well.

Further, the biggest source of greenhouse gas emissions is the energy industry. The greenhouse effect is a natural process that warms the Earthโs surface. When the Sunโs energy reaches the Earthโs atmosphere, some of it is reflected back to space and the rest is absorbed and re-radiated by greenhouse gases.

Greenhouse gases include water vapour, carbon dioxide, methane, nitrous oxide, ozone and some artificial chemicals such as chlorofluorocarbons (CFCs).

The absorbed energy warms the atmosphere and the surface of the Earth. This process maintains the Earthโs temperature at around 33 degrees Celsius warmer than it would otherwise be, allowing life on Earth to exist.

The problem we now face is that human activities โ particularly burning fossil fuels (coal, oil and natural gas), agriculture and land clearing โ are increasing the concentrations of greenhouse gases. This is the enhanced greenhouse effect, which is contributing to warming of the Earth.

At the personal and household level, consumers are facing increasing utility bills. According to the World Energy and Ember Review 2021 Report, average per capita consumption of the average Malaysian consumer increased from 1000 kilowatt-hour in 1985 to more than 5,000 kilowatt hour in 2019. Further in Malaysia, it is estimated that 82% of electricity users are domestic users. Most of the energy in Malaysia is sourced from oil, coal and gas.

Harga sayur-sayuran naik hingga 40 peratus

- Details

15 Jun 2021

15 Jun 2021

SHAH ALAM - Beberapa harga sayur-sayuran mengalami peningkatan mulai Isnin susulan pelaksanaan Perintah Kawalan Pergerakan Diperketatkan (PKPD) di Cameron Highlands, Pahang.

Antara harga sayur-sayuran yang dijangka meningkat ialah tomato, timun jepun, cili, kobis, kacang buncis, lada manis atau lada benggala dan semua jenis salad.

Difahamkan, peningkatan harga berlaku antara 30 hingga 40 peratus kerana pengeluaran terpaksa dihenti serta-merta.Punca utama ialah 12,000 pekerja asing dan tempatan di kawasan tanah tinggi itu tidak dapat keluar bekerja.

Menurut Setiausaha Agung Persekutuan Persatuan-Persatuan Pekebun Sayur Malaysia, Chay Ee Mong, bekalan memang akan terjejas kerana setiap hari Cameron Highlands mengeluarkan sebanyak 565 metrik tan sayur-sayuran.

โSemua sayur-sayuran di Cameron Highlands naik kerana baki bekalan sayur-sayuran tidak sampai dalam 40 peratus. Jadi bakinya itu pasti akan ditawarkan pada harga yang tinggi.

"Hari ini (Isnin) patut sudah boleh nampak kesan kenaikan harga di pasaran. Dijangka petang ini (Isnin), sayur-sayuran akan sampai ke pasar borong. Sebab ini consignment, sudah jual baru mereka bayar kepada petani. Baru kita tahu harga akan melonjak atau tidak tetapi mesti harga melonjak sebab bekalan sayur kurang,โ katanya kepada Sinar Harian pada Isnin.

Pada Sabtu, Menteri Kanan (Keselamatan), Datuk Seri Ismail Sabri Yaakob mengumumkan, antara kawasan di Cameron Highlands yang dikenakan Perintah Kawalan Pergerakan Diperketatkan (PKPD) bermula Isnin ialah Kampung Raja iaitu Sungai Ikan; Blue Valley; Taman Matahari Cerah; Taman Desa Corina dan Kampung Baru Kampung Raja.

Ekoran daripada itu, dianggarkan sebanyak 65 peratus pengusaha kebun sayur di kawasan Cameron Highlands terjejas susulan PKPD terbabit.

Dalam pada itu, Ee Mong berkata, produk sayuran Cameron Highlands bukan sahaja untuk pasaran tempatan malah untuk dihantar ke Singapura.

โBiasanya ada yang dihantar ke pasar borong Singapura. Untuk pasaran tempatan, akan dihantar ke Pasar Borong Kuala Lumpur.

MCMC collaborates with telcos to organise scam prevention campaign as losses exceed RM38mil in Q1 2021

- Details

Monday, 14 Jun 2021

Monday, 14 Jun 2021

PETALING JAYA: The Malaysian Communications and Multimedia Commission (MCMC) announced that a telecommunications crime prevention awareness campaign focusing on phone scams will begin today (June 14).

The campaign will focus on reminding consumers about three types of phone scams, namely voice phishing (the caller impersonates an authority figure to obtain personal banking information from the victim), SMS scam (victim receives an SMS urging them to confirm a banking transaction via an included phone number or link to a fraudulent website) and Transaction Authentication Codes scam (victim is contacted by a scammer impersonating a family member or friend asking for the TAC number, claiming that it has been accidentally sent to them).

MCMC said the campaign will provide tips to identify scams and information on preventative measures via various social media platforms. It will also see the involvement of 15 telco service providers namely Altel, Celcom, Digi, Maxis, Merchantrade, PAVOCOMMS, RedOne, RedTone, Time, TM, TuneTalk, U Mobile, Webe, XOX dan Yes.

The commission said in a statement that fraudulent call scams have cost victims approximately RM38,198,730.01 in losses with 1,392 cases as of March 24 this year, based on reports lodged with the Royal Malaysia Police (PDRM).

PDRM records further show that in 2020, the financial losses for reported fraudulent call scams had increased to RM287,301,039.90 with 6,003 cases compared to RM254,586,210.94 with 5,725 cases in the previous year, according to MCMC.

The regulatory body further stated that it had received 1,290 reports related to phone scams throughout 2020 until May 2021, adding that those involved may be prosecuted under Section 420 of the Penal Code while fixed line and mobile numbers found to be involved in fraudulent activities could be terminated under Section 263 of the Communications and Multimedia Act (CMA) 1998.

MCMC also urged the public to be cautious when receiving unsolicited calls or messages via SMS from unknown individuals and to immediately refer suspicious incidents to the relevant authorities.

Members of the public can provide information and reports on scam-related incidents to the CCID Scam Response Centre through the 03-2610 1559/03-2610 1599 hotline, which is open every day from 8am to 8pm.

Give NGOs a chance for audience with the King, says Fomca

- Details

June 11, 2021 12:22 PM

June 11, 2021 12:22 PM

PETALING JAYA: A consumer group is requesting for civil society to be given the opportunity for an audience with the King, saying NGOs had โtheir eyes and ears on the groundโ.

Commenting on the Kingโs meeting with political leaders since Wednesday, the Federation of Malaysian Consumers Associations (Fomca) said that too often, there is a โhuge gapโ between the reality on the ground and the perception of politicians.

Depending on their position, Fomca president Marimuthu Nadason said, politicians may be over optimistic or overly critical.

He said the parties they represent would very much influence their views on the rakyatโs situation and what needs to be done.

โIt is our feeling that the NGOs have their eyes and ears on the ground. They are closest to the rakyat.

โThey better understand their needs and concerns and maybe better on how best to move forward to overcome the challenges the people face and improve their well-being,โ he said in a statement.

All political party leaders were granted an audience with the King to discuss, among others, the Covid-19 crisis and the emergency.

Earlier today, Umno president Ahmad Zahid Hamidi said he had proposed to the King not to extend the emergency, which is scheduled to be lifted on Aug 1.

Source:

FOMCA terima aduan pengguna sukar dapat minyak peket

- Details

11 Jun 2021

11 Jun 2021

SHAH ALAM- Gabungan Persatuan-persatuan Pengguna Malaysia (FOMCA) dan ahli gabungannya terutama di luar bandar menerima aduan daripada pengguna mengenai kesukaran untuk mendapatkan minyak masak peket di tempat mereka.

Timbalan Setiausahanya, Nur Asyikin Aminuddin menggesa Kementerian Perdagangan Dalam Negeri dan Hal Ehwal Pengguna (KPDNHEP) membuat pemantauan dan meningkatkan pengeluaran kuantiti minyak masak peket supaya lebih ramai pengguna dapat menikmati subsidi minyak masak ini.

Menurutnya, apabila kenaikan minyak sawit yang terlampau tinggi buat masa ini, tidak mustahil ada pihak yang gelap mata untuk mengaut keuntungan lebih.

โPemantauan ke atas minyak masak peket perlu dijalankan secara menyeluruh supaya tiada pihak yang bermain dengan kuantiti minyak masak yang bersubsidi ini dan isu integriti juga terpelihara,โ katanya dalam satu kenyataan pada Khamis.

Beliau berkata, FOMCA amat berterima kasih dengan pihak KPDNHEP negeri yang bertungkus lumus dalam membendung penyeludupan minyak masak ke kawasan sempadan.

โAduan pengguna juga amat berguna dalam membantu pihak KPDNHEP untuk menumpaskan kegiatan penyeludupan minyak masak peket,โ katanya.

Dalam pada itu, Nur Asyikin mempersoalkan mengenai isu kualiti minyak masak peket bersubsidi.

Beliau berkata, ketelusan kualiti minyak masak sangat penting kerana ia melibatkan isu kesihatan pengguna yang menggunakannya.

โPihak berkuasa perlu memantau kualiti minyak masak peket secara berkala, bukannya berdasarkan aduan pengguna supaya kualitinya sentiasa terkawal rapi.

Read more: FOMCA terima aduan pengguna sukar dapat minyak peket

CAP: Ensure local cattle, buffaloes free from lumpy skin disease

- Details

June 10, 2021 @ 9:42am

June 10, 2021 @ 9:42am

GEORGE TOWN: The Consumers' Association of Penang (CAP) has called on the Department of Veterinary Services (DVS) to activate a surveillance programme to detect, control and prevent the spread of lumpy skin disease (LSD) nationwide.

This follows recent reports that LSD, which infects the skin of livestock, was detected in a cattle farm in Simpang Pulai.

LSD is a zoonotic disease (meaning that it cannot infect humans) caused by a type of Capripoxvirus.

The disease is known only to infect cattle and buffaloes.

CAP president Mohideen Abdul Kader said, according to the United Nations (UN) Food and Agriculture Organisation (FAO), the disease was first identified in Africa sometime in 1929 and has since spread to other parts of the world.

He said LSD had reportedly spread in several Asian countries including India, Bangladesh, Nepal, Bhutan, China, Chinese Taipei, Vietnam, and Myanmar and most recently in Thailand.

"The LSD not only causes chronic debility and death in infected farm animals, it also has an economic impact on the world as it disrupts the trade of livestock and livestock products, globally.

"In view of this, CAP calls on the DVS to tighten the conditions for the import of live cattle from abroad in collaboration with the Malaysian Quarantine and Inspection Services Department (MAQIS)," he said today.

Mohideen said the DVS should also take action on any consignment of imported cattle that show symptoms of LSD at the quarantine station.

On Tuesday, the DVS announced a ban on cattle and buffaloes from Thailand after LSD cases were reported in 41 provinces in the country.

Read more: CAP: Ensure local cattle, buffaloes free from lumpy skin disease

Page 61 of 111